south san francisco sales tax rate 2020

The South San Francisco sales tax rate is. You can print a 9875 sales tax table here.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Also what is the sales tax in South San Francisco CA.

. Interactive Tax Map Unlimited Use. South san francisco sales tax increase. South san francisco lies north of san bruno and san francisco international airport in the colma creek valley south of daly city.

The minimum combined 2022 sales tax rate for South San Francisco California is. Donated Medicinal Cannabis Exempt from Taxes. 2020 Natural Gas Surcharge Rates.

Burglary Cases in San Francisco-Oakland-Berkeley CA Rose in 2020. San Francisco CA Sales Tax Rate. South whittier ca sales tax rate.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Tax returns are required monthly for all hotels and motels operating in the city. Citys sewer service charge rate.

This is the total of state county and city sales tax rates. New Sales and Use Tax Rates Operative April 1 2020. South San Francisco CA Sales Tax Rate.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The transient occupancy tax is also known as the hotel tax. Analysis reveals that this state in the South has the highest sales tax rate.

The December 2020 total local sales tax. Collection Procedures for Transient. This is the total of state county and city sales tax rates.

Principal Sales Tax Producers 2020 2020. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. File Monthly Transient Occupancy Tax Return.

San Francisco County has one of the highest median property taxes in the United States and is ranked 52nd of the 3143 counties in order of median. Update to postal code abbreviation table effective may 2020 filing period. There is no applicable city tax.

San Francisco County collects on average 055 of a propertys assessed fair market value as property tax. Health and Homelessness Parks and Streets Bond. You can find more tax rates and allowances for San Francisco County and California in.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. San Franciscos 2020 Ballot will include five tax and bond measures which if passed would provide for a total of 980 million in debt service for bonds and tax increases of approximately 401 to 481 million annually each discussed in greater detail below. The current total local sales tax rate in San Francisco CA is 8625.

The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. With local taxes the total sales tax rate is between 7250 and 10500. Ad Lookup Sales Tax Rates For Free.

Method to calculate South San Francisco sales tax in 2021. Enhanced California Cigarette Tax Stamp Available March 2020. SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. Did South Dakota v. An amgen sign is seen at the companys office in south san francisco california october 21 2013.

The san franciscos tax rate may change. TN Rose in 2020. What is the sales tax in San Mateo County CA.

Georgetown kentucky vs south san francisco california. A 247 Wall St. For tax rates in other cities see.

This is the total of state and. New Local Charge Rate for San Francisco Retail Sales of Prepaid Mobile Telephony Services MTS Effective April 1 2020. The fiscal year ended June 30 2020 marked the second year of.

The County sales tax rate is. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The tax is collected by hotel operators and short-term rental hostssites and remitted to the City.

The current total local sales tax rate in South San Francisco CA is 9875. The average sales tax rate in California is 8551. California has recent rate changes Wed Jan 01 2020.

The December 2020 total local sales tax rate was 9750. What is the sales tax rate in South San Francisco California. Sales Tax Breakdown South San Francisco Details South San Francisco CA is in San Mateo County.

San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days. The California sales tax rate is currently. The combined 2020 sales tax rate for San Mateo County California is 925.

The current Conference Center Tax is 250 per room night. San francisco kron several cities will have a sales use tax hike. The current Transient Occupancy Tax rate is 14.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The South San Francisco California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in South San Francisco California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within South San Francisco California. Effective 412021 the current sales tax rate in San Rafael is 925.

County and is situated 19 miles south of San Francisco and 30 miles north of San Jose. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

The south san francisco california general sales tax rate is 6. Msn back to.

How High Are Capital Gains Taxes In Your State Tax Foundation

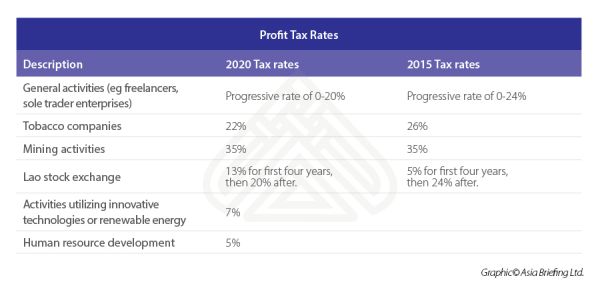

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Here S A History Lesson For All The People Saying San Francisco Is Over

Frequently Asked Questions City Of Redwood City

How Do State And Local Sales Taxes Work Tax Policy Center

California Sales Tax Rates By City County 2022

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

States With Highest And Lowest Sales Tax Rates

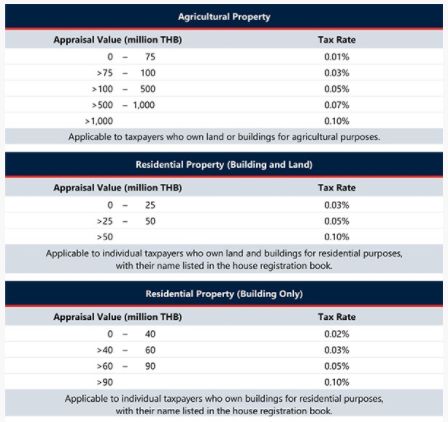

No Change For Thailand S Land And Building Tax Rates For 2022 Tax Thailand

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Do State And Local Sales Taxes Work Tax Policy Center

I Overview In Tax Harmonization In The European Community

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Sales Tax By State Is Saas Taxable Taxjar